A mortgage payment calculator is an amazing online tool that is used when you want to buy your home. It is a tool that can help you in calculating potential mortgages without doing any complicated math and it acts like a digital wizard for you.

Also, when you want to buy the home you have to borrow money from a bank or any other financial institution which is called a mortgage or loan and the person or institution who is giving loan is called mortgage lander. There are many factors to consider when calculating a mortgage like how much money you want to borrow, the interest rate that the bank will charge you on that loan, and also how much time you will take to repay the loan.

To calculate these entire things mortgage calculator is very helpful. It makes the process very simple you have to type all these numbers in the calculator and it will tell you how much monthly installment you have to pay in seconds. It is an outstanding tool which can help you plan your budget and also you can understand how much you can afford for your home.

What is a mortgage payment calculator?

It is a digital handy tool that helps you calculate how much your monthly mortgage payment will be when you are thinking of buying your home. There are many factors which the calculator keeps in mind when calculating mortgage payments like:

Loan Amount

Loan amount means the total money which you are browning from a bank or financial institution to buy your home.

Interest Rate

Different institutions charge different interest rates and this factor tells about the annual interest rate the lender will charge you.

Loan Term

Here you will discuss the years in which you will repay the mortgage or loan.

Down Payment

The down payment is the initial payment you have to pay upfront when buying the home and it will reduce the loan amount.

Property Taxes

Property taxes are annual taxes on property which can vary according to locations.

Homeowners Insurance

Homeowners insurance tells the annual cost of insurance to protect your home.

Private Mortgage Insurance (PMI)

You have to pay for PMI until you have built enough equity in case you have to pay less than 20% of the down payment of the home purchase price.

After putting all these details in the mortgage payment calculator it will take a few seconds to calculate monthly mortgage payments which will include interest rate and principal amount, property taxes, homeowners insurance, and also PMI if needed.

It is the best tool for homeowners to understand and calculate the financial commitment associated with the loan and also allows the users to budget more carefully and effectively when purchasing the home,

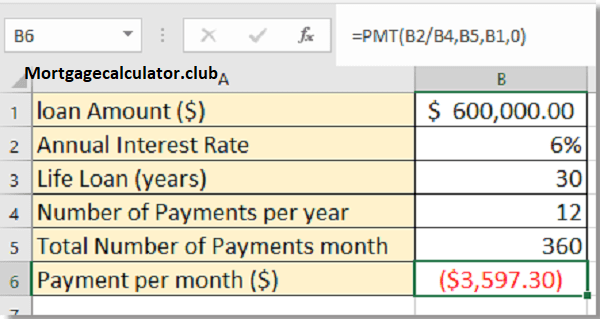

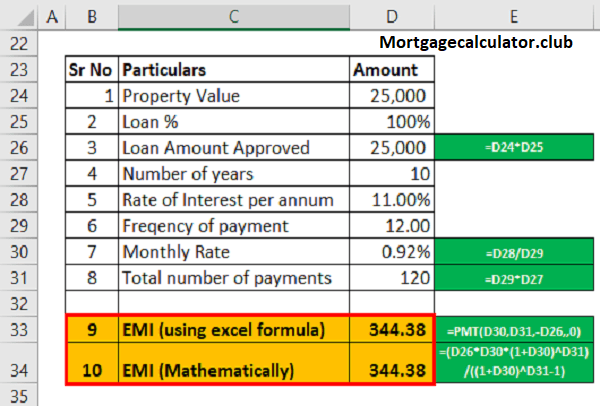

How to calculate mortgage payments?

In this section, we will discuss how you can calculate mortgage payments with the help of a formula.

M = P[r(1+r)^n] / [(1+r)^n – 1]

Where:

- M is your monthly mortgage payment which you have repaid.

- P is the principal loan amount (the amount you borrowed from the bank or financial institution to buy the home).

- R is your monthly interest rate which you can get by dividing it by 12 like dividing the no of months by a year and the output amount will be in decimal points. To understand this we will explain it with an example. If your annual interest rate is 4% then your monthly interest rate will be 0.04/12 = 0.00333.

- Here n is the number of monthly payments that you will make over the life of the loan which can be calculated by loan term in years multiplied by 12.

Here are the steps to calculate your monthly mortgage payment:

- You can easily convert your annual interest rate with monthly decimal points by dividing it by 12.

- You can also determine the total number of monthly payments by multiplying the number of years in your mortgage term by 12.

- You can also use the above formula to calculate your monthly loan payment.

Step 1: Understand Key Terms

Before you start, make sure you know the key terms:

- Principal (P): The principal amount is the initial amount you borrowed to purchase the home.

- Annual Interest Rate (R): The yearly interest rate expressed as a decimal (e.g., 4% as 0.04).

- Number of Payments (N): The total number of monthly payments over the life of the loan, which is the loan term in years multiplied by 12 (the number of months in a year).

Step 2: Calculate Monthly Interest Rate (r)

If you want to calculate the monthly interest rate then divide the annual interest rate by. For example, if your interest rate is 4% then the monthly interest rate will be 0.04/12= 0.00333

Step 3: Calculate Monthly Interest Payment (I)

To calculate the interest portion of your monthly payment, multiply the current loan balance (which starts with the principal) by the monthly interest rate (r).

I = P * r

Step 4: Calculate Monthly Principal Payment (Pp)

Your monthly payment consists of both the principal amount and the interest rate. To find the principal portion, subtract the monthly interest payment (I) from your total monthly payment (M).

Pp = M – I

Step 5: Recalculate Loan Balance

After making a monthly payment, you’ll have a new loan balance. To calculate it, subtract the monthly principal payment (Pp) from the previous loan balance.

New Loan Balance = Previous Loan Balance – Pp

Step 6: Repeat Monthly

For each coming month, you have to repeat 3 and 5 steps which we have discussed above. You have to start with a new loan balance from the previous month and also need to calculate the principal amount and interest rate of the monthly payment. You have to continue by repeating this process until all the monthly payments over the life of the mortgage.

Can I use afford a mortgage calculator?

Yes, you can use an affordability calculator which helps determine if you can afford the mortgage that you are thinking of taking for your home. The affordability calculator works by taking into account your financial information which can be your income, expenses, current debts and also down payment, etc by using this information you can estimate how much you can afford to spend on a mortgage or loan each month.

Here are some steps involved in using an affordability calculator:

Input Your Income

You’ll start by entering your gross monthly income, which includes your salary, wages, and any other sources of income you receive regularly.

Enter Your Monthly Expenses

You’ll input your monthly expenses, including things like utilities, groceries, car payments, student loans, and credit card bills.

Specify Your Down Payment

You’ll indicate the amount of money you plan to put down as a down payment on the home. A larger down payment can lower your monthly mortgage costs.

Choose a Mortgage Term

You’ll select the number of years you want for your mortgage term which can be 15 years and 30 years.

Input Interest Rate

You’ll enter an estimated interest rate. This rate can vary depending on your credit score and current market conditions.

Consider Property Taxes and Insurance

Some calculators allow you to input estimated property taxes and homeowners insurance costs for your area.

Review the Results

After inputting all this information, the calculator will provide an estimate of the maximum monthly mortgage payment you can afford without straining your budget.

Adjust as Needed

If the estimated mortgage payment is too high, you can adjust various parameters like your down payment, interest rate, or home price to see how different choices affect affordability.

How is mortgage insurance calculated?

Whether you have private mortgage insurance (PMI) or government-backed mortgage insurance, such as FHA or VA mortgage insurance, might affect how much mortgage insurance you pay, which is normally calculated as a percentage of the loan amount. For each type, the calculation is done as follows:

Private Mortgage Insurance (PMI)

When you have a traditional loan and your down payment is less than 20% of the home’s purchase price, PMI is frequently necessary. The price of PMI is normally determined by dividing a yearly premium into monthly payments. Your credit score, the amount of your down payment, and the loan-to-value (LTV) ratio are a few of the variables that will affect the specific rate.

Loan Amount

Typically, the amount of your loan is used to calculate PMI rates. The PMI premium increases with the size of your loan.

Credit Score

Borrowers with higher credit scores tend to qualify for lower PMI rates.

Loan-to-Value Ratio (LTV)

This is the proportion of the loan amount to the house’s appraised value. When your LTV hits 78-80%, your PMI premiums may be reduced or even removed when your LTV drops (for example, if you pay off your mortgage or the value of your home grows).

Finding the best PMI rate for your circumstances requires comparing quotes from many lenders because PMI prices might change between lenders.

FHA Mortgage Insurance

You must pay FHA mortgage insurance premiums if you have a Federal Housing Administration-backed loan. FHA mortgage insurance comprises a one-time fee and a recurring fee.

Upfront Premium: Typically, the upfront premium is a one-time sum paid at closing. It can be funded into the loan and is computed as a percentage of the loan amount.

Annual Premium: The monthly yearly premium is determined by the outstanding loan debt and an annual premium rate.

Depending on details like the length of the loan and the amount of the down payment, the FHA mortgage insurance rates may change. It’s critical to confirm the most recent rates with your lender or the FHA directly.

VA Funding Fee

You must pay a VA funding fee if your loan is a VA loan (sponsored by the U.S. Department of Veterans Affairs). The amount of the down payment, your military service, and whether this is your first or subsequent VA loan all affect the charge. It is possible to pay the VA funding fee upfront or to roll it into the loan.

FAQS of mortgage payment calculator

FAQS of mortgage payment calculator:

What is the monthly mortgage formula?

The formula to calculate your monthly mortgage payment can be expressed as:

M = P[r(1+r)^n] / [(1+r)^n – 1]

How is a fixed mortgage calculated?

To calculate the fixed mortgage you have to consider three main components the principal amount * interest rate divided by time (P*R)/T.

What percent is a fixed-rate mortgage?

Below are Weekly national mortgage interest rate trends

30 year fixed

7.49%

15 year fixed

6.79%

10 year fixed

6.71%

5/1 ARM

6.55%

Conclusion

The RV Mortgage Calculator is a versatile tool that is very helpful for anyone who wants to purchase a home. You don’t need to be involved in complex math calculations as it will solve each and everything in seconds. Anyone can use it to understand his/her financial commitment when buying a home.

By putting some important information like loan amount, interest rate, loan term, property taxes, bad credits and insurance details you can make informed decisions about your budget and affordability. The above available mortgage payment calculator is free to use which is equally best for experienced home buyers and new users. You can perform various comparisons for different interest rates.

Also, it is free to use there are no hidden charges and you don’t need to make an account or register to use the calculator. Simply paste the required amounts and calculate your mortgage monthly payments and other things.